Bond Duration and Convexity

Background

If an investor is given a choice of two 10-year bonds to choose from, one with a 10 percent coupon rate and the other with a 5 percent coupon rate. Assuming the risk of default is the same for the two bonds, the investor will likely choose the one with the higher coupon rate. From a returns perspective, the 10 percent coupon allows the investor to recoup his or her investment in a shorter time frame. The shorter time frame is considered good as it allows the investor to be less exposed to a risk known as the Interest Rate Risk.Interest Rate Risk

Interest rate may go up or down at different points in time for different reasons. For example, during a recession, interest rate will be cut to kick-start the economy. When the economy recovers and exhibits behaviour of inflation, the interest rate may increase. It is known that when interest rate goes up, it causes a decrease in the price of a bond. The reverse where interest rate goes down causing an increase in bond price is also true. The risk of the decrease in the price of a bond due to an increase in the interest rate is known as the Interest Rate Risk.One of the factors affecting the Interest Rate Risk is the maturity of a bond. With a longer time frame, the bond is more likely to subject to change in price due to a interest rate change. The other factor affecting the Interest Rate Risk is the Coupon Rate. A higher coupon rate allows the price of the bond to be recovered in a shorter time frame and thus expose an investor to less Interest Rate Risk.

Reinvestment Rate Risk

We might think that since a decrease in interest rates lead to an increase in Bond Price, it will not in anyway adversely affect a bond's investor. However, a decrease in interest rate will lead to a decrease in future income of the bond investor. For example, the coupon amount received by an investor can only be reinvested in lower yielding bonds. This risk of a decrease in income due to a decrease in interest rates is known as the Reinvestment Rate Risk.Bond Duration

In 1938, Federick Macaulay conceived the idea of a measurement call the Duration to measure the Interest Rate Risk. It combines the maturity of a bond and the coupon rate and can be thought of as how long it takes for the price of a bond to be recovered.Macaulay Duration

Macaulay Duration can be calculated as follows:Duration = Sum ((Present Value of Cash Flow at Time t * t) / Bond Market Price)

- t - the time period of the cash flow. If the number of years to maturity is 10 then t is 1 to 10.

- Present Value of Cash Flow at Time t - The present value of the cash flow is discounted using the Yield to Maturity.

- Bond Market Price - The present value of all cash flows of the bond.

Modified Duration

One of the interesting side effects of Macaulay Duration is that it can be adjusted to approximate the interest rate sensitivity of a bond. This is the approximation of the percentage change in the price of the bond to the percentage change in yield. The basic assumptions are that the bond is not tied to any Options and changes in yields are small.Modified Duration is calculated as follows:

Modified Duration = Macaulay Duration / (1 + (Current Yield to Maturity/Number of Payments in a year))

Bond Convexity

Modified Duration can be used to approximate the price change of a bond in a linear manner as shown in the formula above. In fact, the price and change in interest rate change relationship is not exactly linear. The relationship is actually curvilinear. The diagram below shows the approximation using Modified Duration as a straight line and the actual price-interest rate change relationship as a curve. It is important to note that the degree of the "curvature" of the curve is known as the convexity.

How to use the Bond Convexity

Bond Convexity is defined formally as the degree to which the duration changes when the yield to maturity changes. It can be used to account for the inaccuracies of the Modified Duration approximation. On top of that, if we assume two bonds will provide the same duration and yield then the bond with the greater convexity will be less affected by interest rate change. This can be easily visualized from the diagram above where the greater the "curvature", the lesser the price drop when interest rate increase.Bond Duration and Convexity Spreadsheet

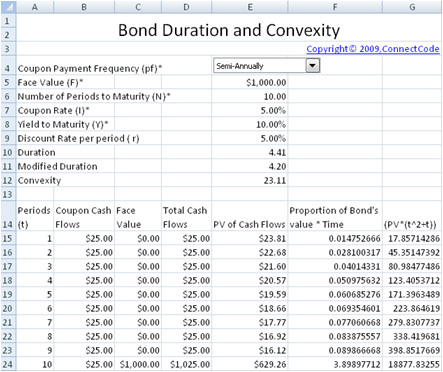

The "Bond Duration" worksheet allows you to calculate the Duration of a bond quickly and easily.

Input Values

-

Coupon Payment Frequency (pf) - This field indicates whether the coupon is paid annually or semi-annually. The coupon rate is typically stated in an annual percentage. Thus if a coupon is paid out semi-annually, the coupon payments is equivalent to :

(Coupon Rate / 2) * Face Value of the Bond - Face Value (F) - The principal or loan amount of the bond to be repaid at the end of the maturity period.

- Number of Periods to Maturity (N) - This field is related to the Coupon Payment Frequency. If Coupon Payment Frequency is set to Semi-Annually, Number of Periods means number of Half-year period. If Coupon Payment Frequency is set to Annually, then Number of Periods means number of One-year period. This field is used in the calculation of the Bond's Yield to Maturity.

- Coupon Rate (I) - This is the stated annual interest rate payments for a Bond. This interest rate multiply with the Face value gives the periodic coupon payments.

- Bond Price (v) - The current price of the bond in the market. Bond prices fluctuates due to changes in interest rates and the price that the bond is purchased affects the Yield to Maturity.

- Yield to Maturity Type - This Bond Valuation spreadsheet distinguishes between the Annual Percentage Rate and the Effective Annual Rate. When people talk about yield to maturity, they typically refer to the Annual Percentage Rate. The Effective Annual Rate basically takes into account the effect of compounding interests of the coupons.

Output Values

- Discount Rate per period (r) - Yield to Maturity is typically quoted like an Annual Percentage Rate. This discount rate is the exact rate per period. For example, if the Coupon Payment Frequency is semi-annually, then this discount rate is the rate per six months.

-

Duration - Macaulay Duration. The composite measure of interest rate sensitivity of a bond. In the spreadsheet it is calculated as follows:

Duration = Sum ((Present Value of Cash Flow at Time t * t) / Bond Market Price)

The Bond Market Price is calculated as the sum of the values in the column "PV of Cash Flows". - Modified Duration - Adjusted Macaulay Duration. Also known as the Modified Duration. It is calculated as Macaulay Duration divided by 1 + yield to maturity.

- Convexity - The degree to which the duration changes when the yield to maturity changes. The column "(PV*(t^2+t))" is used for calculating the Convexity of the Bond. The formula for calculating bond convexity is shown below.

Estimating price change using the Modified Duration

The "Using Modified Bond Duration" worksheet can be used for estimating the price change of a bond when there is a change in Yield. The price change is estimated using the Modified Duration.

Input Values

The following three input fields (which are explained in this document above) are used for calculating the Modified Duration:- Coupon Payment Frequency

- Yield to Maturity (Y)

- Duration

Output Values

- Modified Duration - Adjusted Macaulay Duration. Also known as the Modified Duration. It is calculated as Macaulay Duration divided by 1 + yield to maturity.

- Percentage Change in the price of the Bond - This is calculated as

(-(Modified Duration)/(1+Y)) * (Percentage Change in Yield).

Download Free Bond Duration and Convexity spreadsheet - v1.0

System RequirementsMicrosoft® Windows 7, Windows 8 or Windows 10

Windows Server 2003, 2008, 2012 or 2016

512 MB RAM

5 MB of Hard Disk space

Excel 2007, 2010, 2013 or 2016

License

By downloading this software from our web site, you agree to the terms of our license agreement.

Download

FreeBondDurationAndConvexity.zip (Zip Format - 29 KB)

Get the Professional version

Benefits- Unlocked

- Allows removal of copyright message in the template

- Allows commercial use within the company

- Allows customization of the model

- Full source code

Bonus

- Includes the Professional Bond Valuation and Yield to Maturity spreadsheet

- Free Visual Basic for Applications Training worth USD$30 (Over 100 pages!)

USD30.00 - Purchase